Housing’s yearslong winter might be showing the first hints of thaw, according to new data from the NBC News Home Buyer Index.

Buyer difficulty is easing, owing to improving supply and less competition. However, prices remain high, and experts say any improvement could ride on policy decisions — tariffs and trade wars chief among them.

The Home Buyer Index is a scale from 0 to 100 that measures the difficulty a buyer would have trying to purchase a house in a given month. The February index value came in at 80.1 — down from pandemic highs in the upper 80s, but still a figure that represents extreme difficulty.

We've got the news you need to know to start your day. Sign up for the First & 4Most morning newsletter — delivered to your inbox daily. Sign up here.

Several factors point to easing difficulty. Inventory is improving, with more homes coming onto the market and higher than expected starts. And mortgage rates are declining slightly, especially those benefiting first-time buyers using Federal Housing Administration loans.

Homes are also spending more time on the market: 40 days or more on average — a sharp contrast to 2021’s hottest stretch, when homes flew from the market in under half that.

U.S. & World

The day's top national and international news.

Those dynamics are reflected across the Home Buyer Index’s sub-indexes. The Home Buyer Competition Index came in at 63.4, a decline to its prepandemic levels, and the Home Buyer Scarcity Index followed a similar path at 68.4.

But economic uncertainty stands out, as the Home Buyer Economic Instability Index registered at 91 — higher than this time last year.

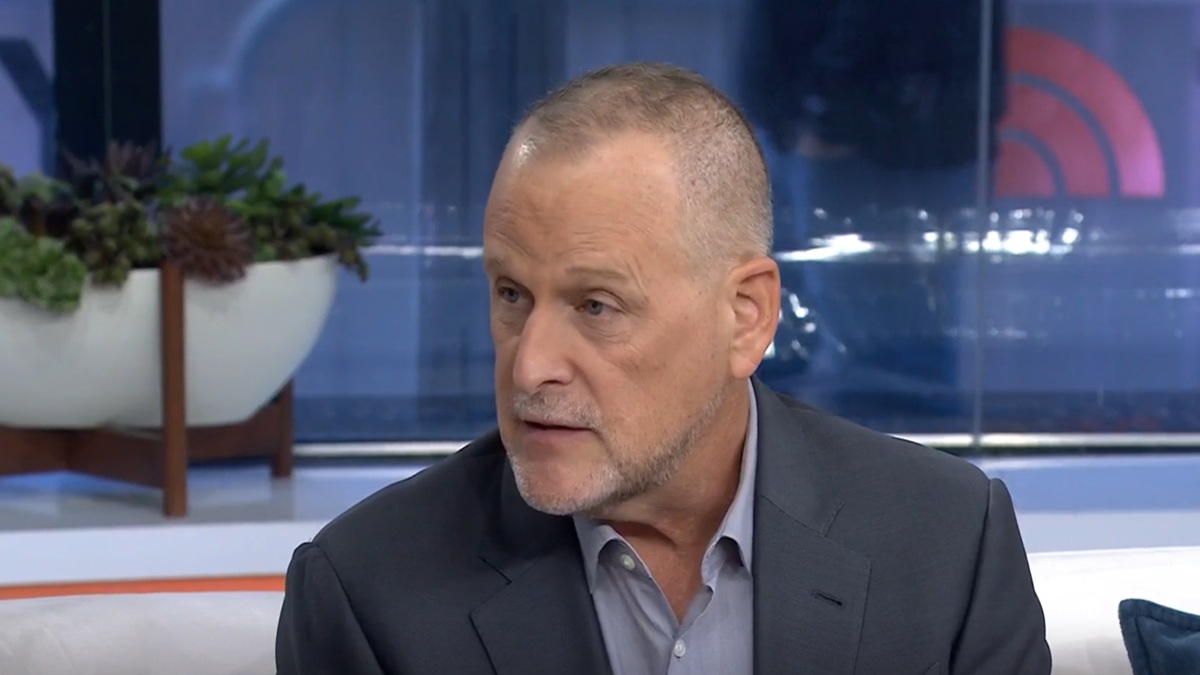

“Buyers who are ready and qualified have more opportunity now than they did a year ago,” said Vinny Rodriguez, a senior loan officer at Fulcrum Home Loans, an Idaho company with customers in much of the country.

Rodriguez said he’s seeing more of his clients come out of waiting. Nationally, there’s also been an uptick in mortgage demand, which is at its strongest in months. While affordability remains a high hurdle, many of these buyers, Rodriguez said, are beginning to accept current market conditions.

Still, he cautioned, economic policy remains a major question mark and the modest relief could be short-lived.

Much of that uncertainty, Rodriguez said, comes from trade talk.

“Every headline is like, ‘Do I go left, do I go right?’” Rodriguez said. “When the market is uncertain in the ways it has been, that could slow the development of building and also homes being sold.”

On the industry side, homebuilders are feeling glum amid tariff talk. Builder sentiment is dropping as everything from lumber to appliances is expected to grow pricier. That could offset progress on inventory shortages and affordability — with some building contractors already hiking prices as much as 20%.

Rodriguez described the keys to stabilizing the market: slow home value appreciation and steady declines in interest rates. In a market that’s been shakier on the supply side, he noted, rapid changes ratchet up prices, and therefore buyer difficulty.

“I would prefer if we stayed the course,” Rodriguez said. “Any sudden movements are going to have people reacting fast.”

See what the housing market looks like in your area.

This article first appeared on NBCNews.com. Read more from NBC News here: