Columbia Business School professor Rita McGrath shares how to spot signs of a looming recession and gives advice on preparing for the worst.

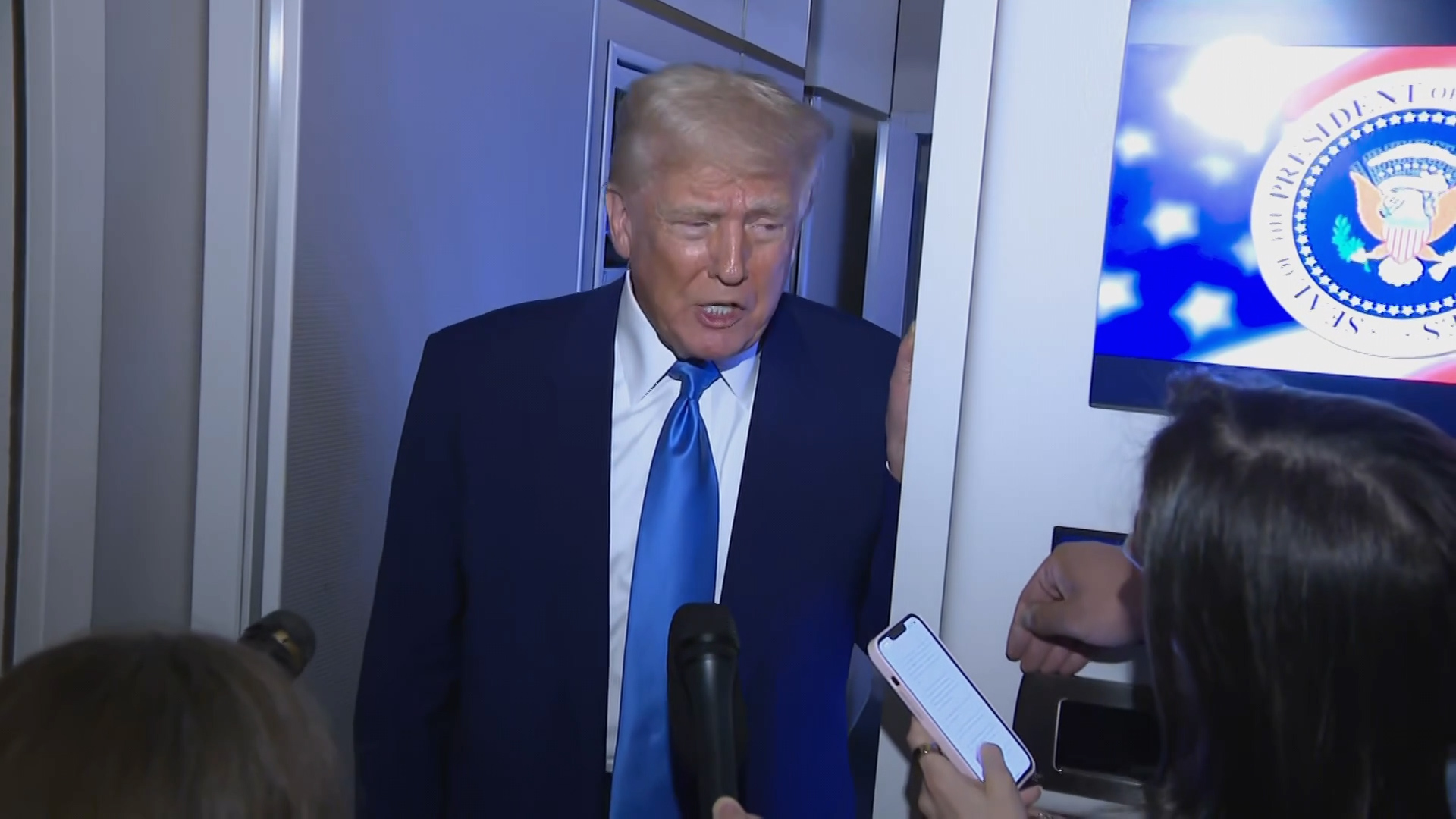

President Donald Trump's sweeping 10% tariffs across all imported goods inspired the sharpest single-day decline the U.S. stock market has seen since 2020 — and with it, consumer anxiety about a possible economic recession.

Rita McGrath, a professor at Columbia Business School, says there are ways to ease the financial burden while confronting the reality that comes with a period of economic decline.

Tips to prepare for a recession

We've got the news you need to know to start your day. Sign up for the First & 4Most morning newsletter — delivered to your inbox daily. Sign up here.

Stay calm

Financial uncertainty can understandably increase stress and anxiety levels.

But dwelling on the negative possibilities too much can overload your brain and impact your ability to get organized and properly safeguard your finances, according to McGrath.

"As a general rule, we don't tend to make our best decisions in panic mode," she explained. "The more centered, the calmer you can be, [the better]. Take a lot of deep breaths."

Build up a financial buffer

The best way to brace your finances for a recession, McGrath said, is to build up some financial padding in case you need some extra cash to fall back on.

"What you'll find is that during recession-era times, the people that have thought ahead a little bit ... will find they're worried a lot less than people that are living right close to the edge," she explained.

According to McGrath, those planning for or experiencing a recession tend to dip into their savings or use their credit cards more often. Instead, consumers should add to — or set up — their rainy day fund and refrain from using their credit cards too much.

Reevaluate your subscriptions

With the ever-increasing number of streaming services available today, it's hard not to have more than one. But nobody needs all of them, McGrath said.

Reviewing all of your subscriptions and determining if there are any you use less frequently — or can otherwise live without — is one quick and easy way to cut spending.

"We don't tend to make our best decisions in panic mode."

Rita McGrath, Columbia Business School professor

Don't obsess over investments and 401ks

Even in financially comfortable times, the stock market shifts every day. Obsessively monitoring your 401k investments will only increase the financial anxiety a recession inspires, the professor said.

"The markets are gonna do what they do," McGrath said. "We know that over the long term — and that's years, not minutes, not days — that the equity markets tend to perform better than other kinds of investments, so my advice would be steady in on the till there."

She also explained that those who trade less frequently typically accrue more earnings than those who trade more actively.

Vacationing? Reconsider costly commitments

If you're on the brink of committing to a family vacation, a wedding, or another resource-intensive excursion, this might be a good time to revisit your finances and see what you could still afford if a recession were to hit.

"You really want to be running those numbers. How bad could it get? At what point would you want to not go forward with those plans?" McGrath said. "The last thing you want is to have all of these half-made commitments out there in the world, and then the economy does something you didn't expect, and now you're sort of on the hook for all that."