If the impact on your bank account balance didn't make you start to wonder, the dozens of think pieces poking at the question may have: How much of rising inflation — which has led to skyrocketing costs for groceries, furniture and technology — is actually just corporate greed?

Everything is expensive right now. We've all heard that the price spikes are due to the unfortunate circumstances of 2020 and beyond: the quarantine, the worker crunch, the supply chain issues, the international wars.

"...Things got particularly expensive during that period," said Ron Hill, a marketing professor at American University. "And some companies haven't rolled back those costs at all."

But the S&P 500 (the index that tracks stock price performance for the 500 biggest companies in the stock market) ended Feb. 22 with a new record high. And with corporate profits in the last quarter of 2023 higher than at any other point in the year, companies seem to be doing just fine.

We've got the news you need to know to start your day. Sign up for the First & 4Most morning newsletter — delivered to your inbox daily. Sign up here.

After four years of time for the market to adjust around the issues above, inflation has only now started to slow. So, to many people, the climb of inflation being considered "natural" is starting to seem like nonsense. And to some, the more likely explanation seems like "greedflation."

How costs impact companies' estimated profits

In order to price goods and services at a level that will allow companies to make back the money they spend and make a profit, they have to estimate what stuff will cost in the future.

For example, if the previous year saw a lot of forest fires and higher gas costs, lumber may have been harder to come by and harder to transport across the U.S. That means a furniture company in D.C. would need to anticipate higher costs, and raise the price of their tables and chairs accordingly to make back what they spend running their business.

According to Hill, that whole process is not an exact science.

"We have to remember that prices, even though it sounds like it could be very scientific ... most of it is really guesswork," Hill said. "And so organizations typically determine their prices based on what they expect things to cost in the future, rather than what they've cost necessarily in the past."

Some of the increases in price really do come down to supply chain disruptions and skyrocketing demand in ways that no company could predict (hello, toilet paper hoarders of 2020). The times really were unprecedented.

That's the explanation Andrew Glover, an economist at the Federal Reserve Bank in Kansas City, gave to NPR. Essentially, he believes that companies overshot their estimates of how much costs would increase from 2021 to 2022, creating a kind of self-fulfilling prophecy of inflation.

But some of the increases in price, Hill said, are not just misplaced estimates.

"Sometimes it is greed," he said.

Hill, in addition to his time as a professor, has worked as a consultant for a number of corporations. He says that some of the statements companies make about their own profits are inconsistent, depending on the audience.

"When I look at most statements that companies, corporations, give to the federal government when they file their tax returns, they're trying to say, 'We didn't make any money,'" Hill said. "And then if they're trying to go out to their stockholders and other people, they're trying to say 'We made so much money!'"

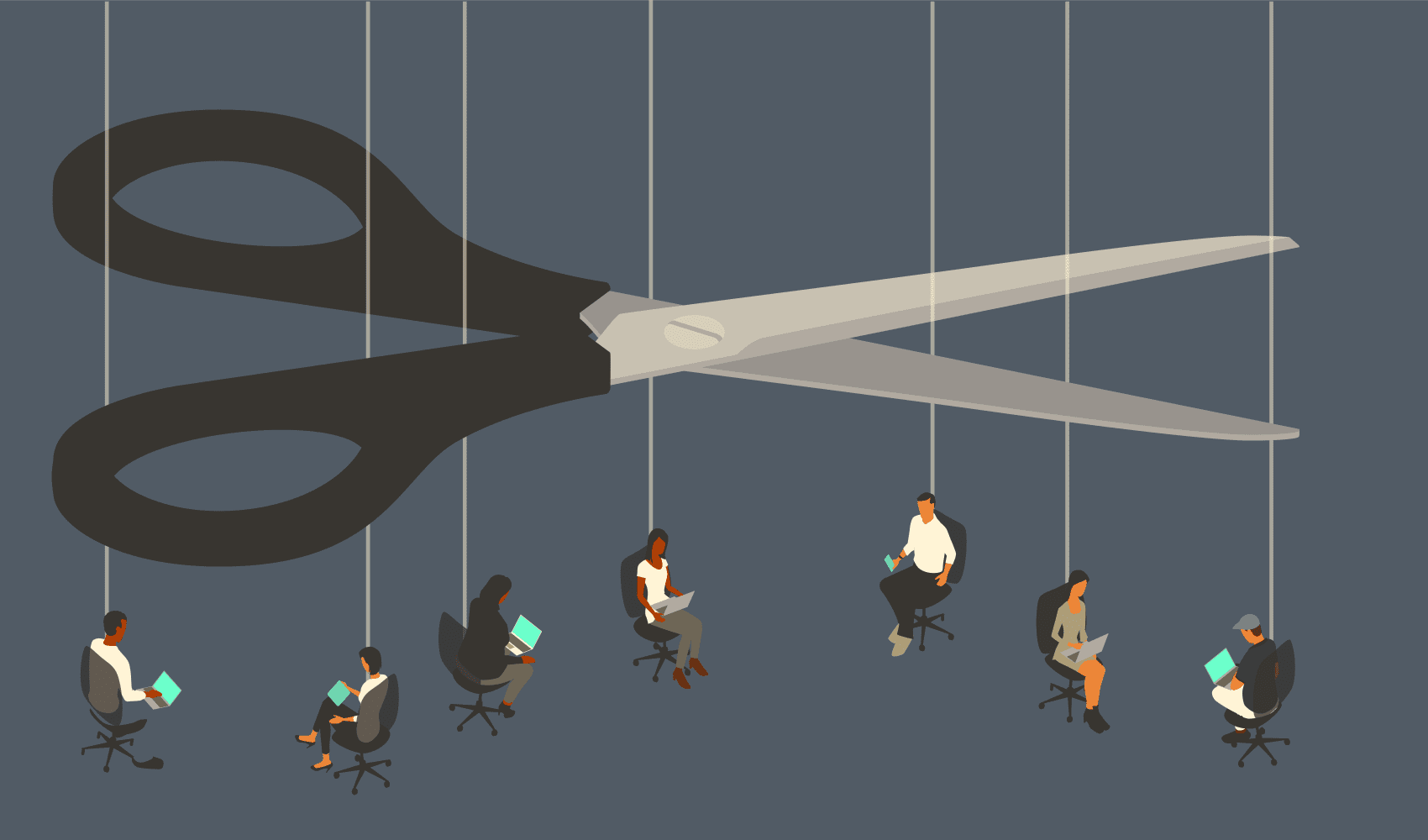

Corporations are made up of people, and people are by and large trying to make a living from their jobs, Hill said. But most of the companies he's worked with as a consultant or interacted with as a professor are focused on increasing profits year over year — sometimes to the detriment of other goals.

"The truth is, most organizations, particularly those that think of themselves as for profit, are constantly looking for ways to take more from consumers and to give less back to them," Hill said. "And that's the way in which they describe profit."

How much does inflation come down to 'greedflation'?

Many factors — a tight labor market, supply chain challenges, wars on the other side of the planet — contribute to inflation. That can make the amount that corporate greed contributes to the problem a little fuzzy and difficult to parse.

So, what facts can we examine to determine what role soaring corporate profits play in high inflation?

There have been a number of reports on the phenomenon since prices started creeping up. One widely covered report released in January by progressive think tank Groundwork Collaborative came to a stunning conclusion:

"From April to September 2023, corporate profits drove 53% of inflation," the group said on the webpage for the report. "Comparatively, over the 40 years prior to the pandemic, profits drove just 11% of price growth."

The report argues that corporate profits have stayed high even as input costs (the expense of providing a good or service) have gone back to pre-pandemic levels. Furthermore, it says, corporate profits now make up a greater proportion of the U.S.'s national income, while the share of corporate income that workers see has continued to go down.

Other outlets and opinions columnists have other explanations. Those range from calling increases in profits a logical response to high demand, to arguing that price increases aren't corporate greed because there's also been an increase in workers' share of national income, compared to the previous decade. But that ignores the fact that workers' share had declined for most of the early 2000s and for the first half of the 2010s.

According to Hill, the timing of the price changes — and the areas those prices went up and stayed up — implies some profiteering.

"Following the pandemic, organizations were able to change their price structures to fit the fact that demand often exceeded supply," Hill said. "It's a natural tendency to increase things. What's different is, they continue to do that. They continue to do it particularly in areas where the products were absolutely essential for people to buy."

Over time, those increases became normal to us.

"We got used to seeing prices go up, particularly in certain food items and other kinds of products," Hill said. "Housing went way up, et cetera. So what happened over time is, marketers and companies have decided they can continuously increase their prices, and they can do that particularly in goods and services that we absolutely need. So why not do that if you can get away with it?"

What can we do about 'greedflation'?

The problem — especially for lower income workers, people on fixed incomes and young workers without much in savings — is that you can't forego necessities. No matter how much of your paycheck it cuts into, you need food to eat, a home to sleep in, and transportation to and from your job.

"People are wondering why, under inflationary circumstances, people are continuing to buy such items," Hill said. "They're doing it because it's the only way in which they can continue to survive and even hope to thrive."

Some Americans were able to save more during the pandemic than they could under other circumstances, and those folks emerged from the months of quarantine with cash to burn. But many Americans, by some measures up to 78% of them, are living paycheck to paycheck, with no ability to save.

"When you can't put nutritious food on the table, when you can't pay your rent, when you can't pay the electrical bill or your heat, when you can't make the payments on your car, what do you decide to do with the money that is coming in for the most part? It's triage," Hill said.

"It's like looking at physicians who are dealing with a catastrophic event. You're trying to do what you have to do in order to survive in a particular moment, because that's going to allow you to get by today. Maybe not tomorrow, but you've got to get by today to see tomorrow," he said.

A large swath of the population that has to choose between saving for retirement or making rent is bad news for consumers.

So what can we do about it?

One piece is government regulation, Hill says, but it's not exactly easy.

"We know that the government will often say it's illegitimate to change prices over time if there's some kind of natural disaster or some other calamity that causes people not to have access ... but it's very rare for our government to step in and say to a private company, 'You can't raise prices because we don't want you to,'" he said.

A few members of Congress have introduced legislation related to "greedflation" since pandemic-related inflation took hold. Back in 2022, Sen. Elizabeth Warren, D-Mass., and a handful of other lawmakers introduced a bill to prevent price gouging. Sen. Bob Casey, D-Pa., tried again in February of this year with some of his colleagues, introducing the Price Gouging Prevention Act.

But such efforts have been slow-moving and mostly unsuccessful.

The other way to limit corporate greed, Hill said, is greater competition between companies.

"We don't have what we would think of as a natural competition because there are what we call barriers to entry," Hill said.

For instance, it's hard to start a new grocery chain right now, for example, because a new owner can't compete easily with other chains that already have 500 locations.

"And when those barriers to entry are really high, then we end up having a handful of companies selling these goods or services to consumers ... and the consumers don't have a lot of options," Hill said.

Consumers can't pick an alternative to Coke or Pepsi, for example, because most fast food restaurants carry one or two particular brands, Hill said. And while there are lots of other sodas, a majority of them are owned by the Coca Cola company and PepsiCo.

But there are efforts in the federal government to change those circumstances.

As mentioned above, senators and members of Congress have brought forth legislation aimed at companies that price gouge and profiteer.

Increasing economic competition has also been a focus for President Joe Biden during his time in office. In July 2021, Biden signed an executive order that created the White House Competition Council, a group dedicated to efforts that "increase competition and deliver concrete benefits to America’s consumers, workers, farmers, and small businesses."

"...When there are only a few employers in town, workers have less opportunity to bargain for a higher wage and to demand dignity and respect in the workplace," the White House said on a webpage about the Council's efforts.

The Justice Department has also brought antitrust lawsuits against several giants of the American economy, including Amazon, Google, and Penguin Random House and Simon and Schuster. There are also rumors of an antitrust lawsuit being brought against Apple as early as this March.

Such efforts might help increase competition and lower inflation and other price hikes when in technology, books, and groceries. But the biggest piece of most people's monthly budget, housing, has a little more to it again. You can read more about that here.

News4's Digital Managing Editor Carissa DiMargo and Digital Content Producer Sophia Barnes contributed to this report.