As more states legalize pot for either recreational or medicinal purposes, people trying to buy it legally are still faced with a big obstacle. News4’s Mark Segraves explains.

A new medical marijuana dispensary opened on U Street NW Monday. However, despite the drug’s legal status, customers in D.C. face obstacles when buying marijuana.

The drug often can’t be purchased with a credit card, and insurance companies don’t cover the cost. A total of 33 states have legalized marijuana for either recreational or medical uses, but other laws need to be passed in order to improve consumer’s access.

“It’s not the least expensive thing to purchase, so I have to carry cash. My last purchase was $95,” said former D.C. Council member and medical marijuana user Yvette Alexander. “It’s inconvenient; I would like to see the day when we can charge this like everything else, like your pharmaceutical drugs.”

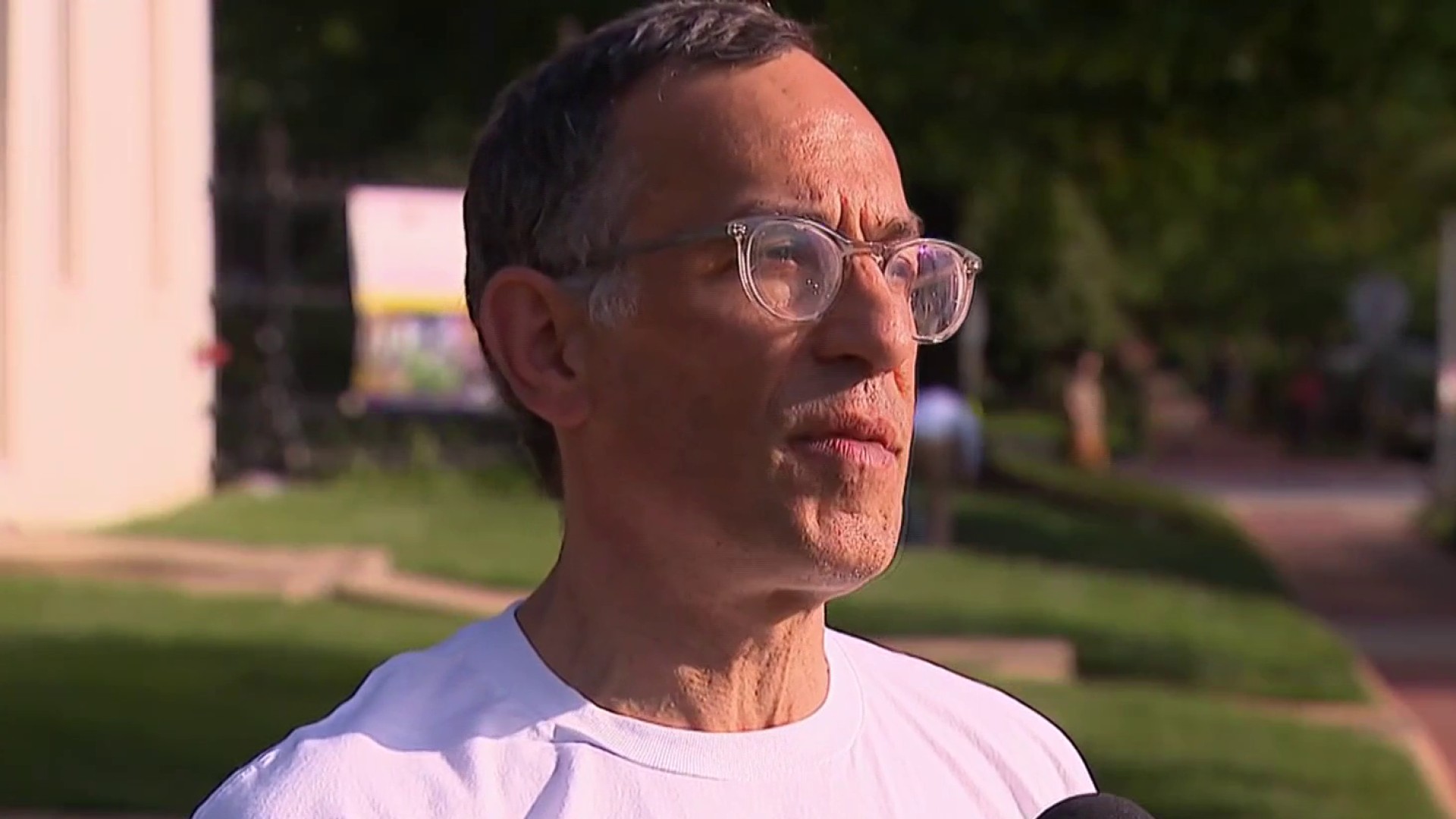

A co-owner of the newly opened dispensary Capital City Care said owning a cannabis company comes with its own set of challenges because of state and federal regulations.

“It’s the banking laws, from a federal level," George Denardo said. "So the banks are federally insured, and since this is against federal regulations most credit cards will not accept medical cannabis as a valid transaction.”

Members of Congress are talking about legislation that would allow banks to consider medical marijuana like any other legal drug. D.C. Delegate Elanor Holmes Norton said it's a bipartisan effort.

“I’m very pleased that half the Republicans voted with us on that bill, which makes me believe we can even get that bill through the Senate,” Holmes Norton said.

Local

Washington, D.C., Maryland and Virginia local news, events and information

Before Congress takes action, businesses have to find ways around credit card bans from banks. One company with marijuana dispensaries in 15 states launched its own credit card for purchasing weed.

It has only been approved in a few states, but the company hopes to expand to other states soon.