You may have noticed that everything is expensive now -- and data from the U.S. Bureau of Labor Statistics confirms what your bank account already knew.

The reason for all those elevated prices is, you also may have heard, mostly inflation. (There may be other factors behind price increases, but you can learn more about that here.)

Inflation increases during the pandemic have hit many Americans hard -- and for Americans on fixed incomes, with low wages or just entering the job market, it hit even harder, according to Ron Hill, a marketing professor at American University.

"What we're finding is the people with the greatest restrictions in their ability to buy -- because they have lower incomes, lower access to credit, and they typically have families where they have lower incomes and lower access to credit -- are still forced to buy food, and the kind of products that have gone up over time," Hill said.

We've got the news you need to know to start your day. Sign up for the First & 4Most morning newsletter — delivered to your inbox daily. Sign up here.

Even as prices go up, people still need to eat, and these groups can’t mitigate inflated costs by saving in other places, Hill said.

But if inflation causes so much pain, why don't economists think it's universally terrible?

What good does inflation do?

According to Sarah Foster, a researcher covering the U.S. economy and the Federal Reserve for Bankrate, inflation isn't inherently bad or concerning for the economy -- as long as wages keep pace with it.

In fact, Foster said, "a little bit of inflation is actually better than no inflation at all."

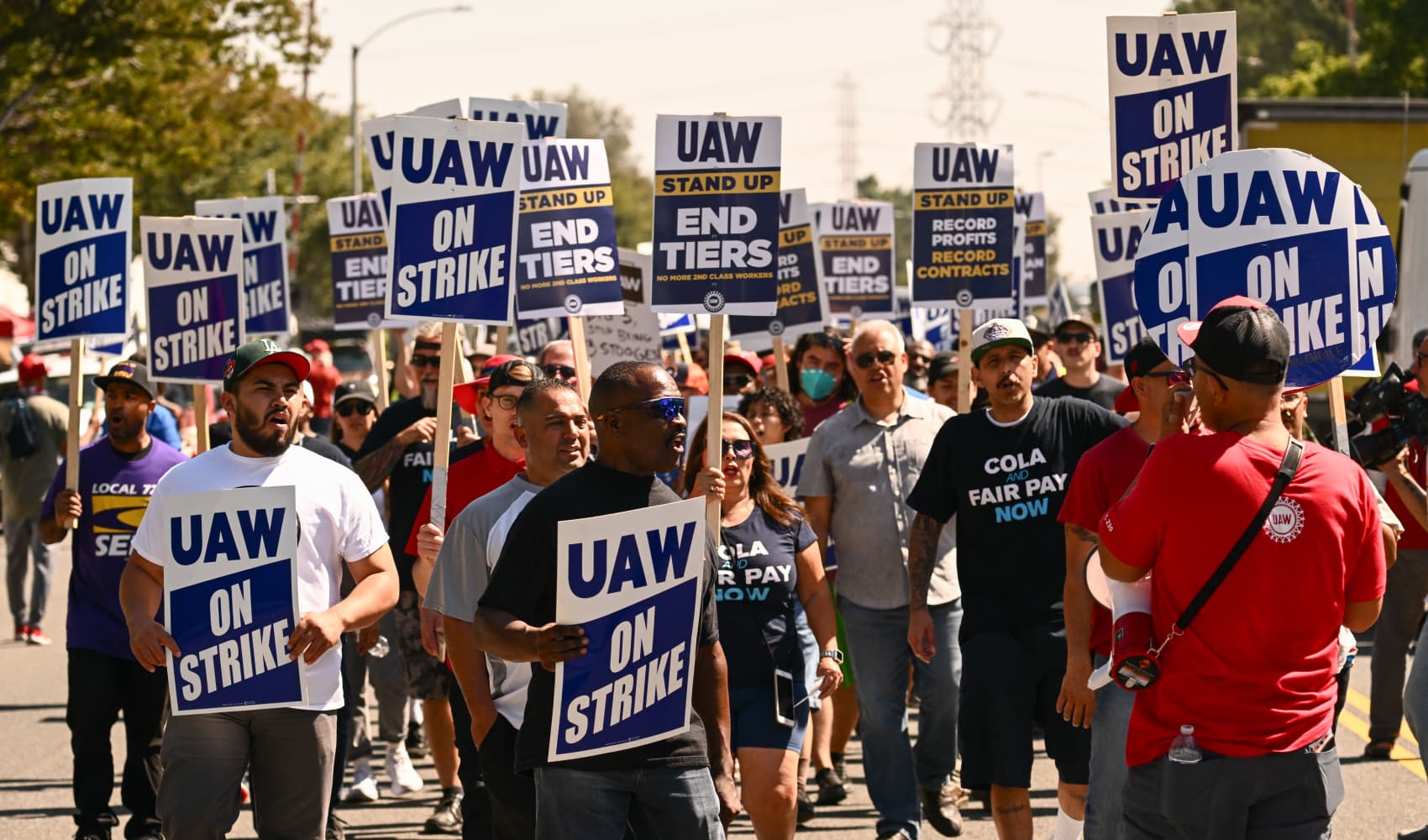

"Goldilocks inflation," as Foster calls it, gives American workers bargaining power to argue for higher wages over time.

That's why so many companies offer annual pay raises. For employers to keep the workers they have, to avoid spending more money on hiring and training new employees, salaries need to keep pace with inflation. Otherwise, employees effectively are taking pay cuts.

It's also why many people can earn more money if they move to a new company. If their current employers won't pay an adequate wage for skills a competitor wants, workers can leverage their abilities and the cost of living to negotiate their pay upward.

Why is it bad to have no inflation?

If inflation dips too low, it might be a sign the economy isn't growing very fast, which makes it harder for workers to bargain for those raises.

The problem with inflation comes when it increases too much. When the bargaining process between workers and companies moves slower than inflation, salaries don't cover people's expenses. That's when people have trouble affording coffee that suddenly costs $50 more over the course of a year.

Rather than leaning on deflation, the better solution to the problem of "my paycheck doesn't cover my expenses," according to Foster, is to increase the amount of money in your paycheck.

"I think what actually would be important for Americans to feel better is if their wage growth fully recovers and their purchasing power beats inflation," Foster said.

The obvious next question, of course, is: Will wages ever increase enough to match the recent increases in inflation?

For some lucky Americans, that wage increase has already taken place. For others, economists are hopeful that it's on the way. You can learn more about that here.

News4's Digital Managing Editor Carissa DiMargo, Digital Content Producer Sophia Barnes and Consumer Reporter Susan Hogan contributed to this report.