The U.S. Postal Inspection Service is warning consumers about common new scamming methods.

You’ve seen the warnings about phishing scams, when a scammer sends you an email impersonating a trusted company to get you to share your personal information. But now scammers are coming up with new tricks.

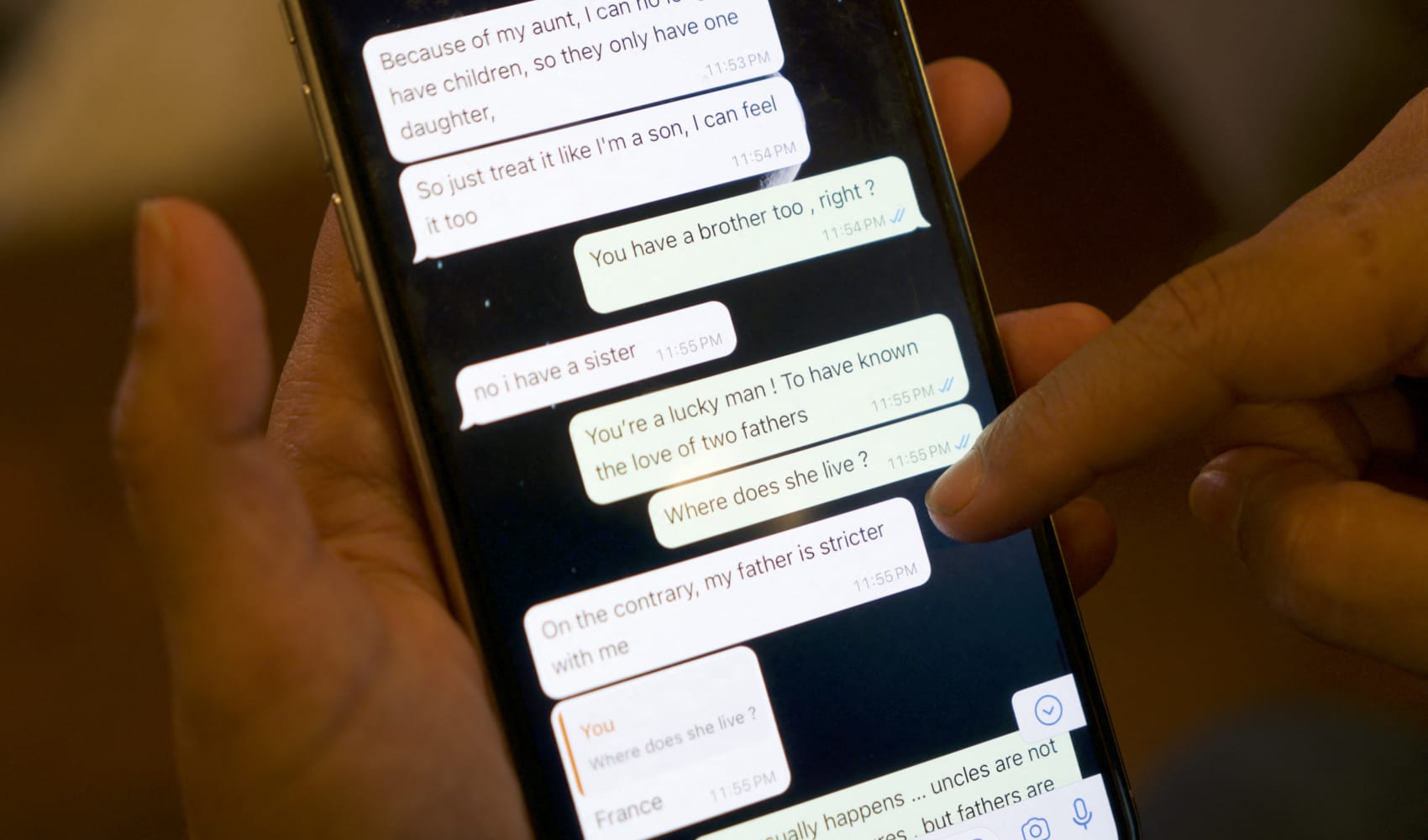

"So newer scams are coming out. So we're seeing smishing, which is using text messages," Inspector USPIS Keith Nusbaum said.

A perfect example of smishing is a text message claiming to be from the United States Postal Service, saying they are unable to deliver a package ... unless you confirm your address at a link in the message.

We've got the news you need to know to start your day. Sign up for the First & 4Most morning newsletter — delivered to your inbox daily. >Sign up here.

"That link does not go to the postal service and the message isn't from the postal service," Nusbaum said. "But once you go there and you provide your name, your address and personal information, now those scammers have that information."

Scammers are also leaving voicemails claiming to be government employees.

"Vishing is using spoofed phone numbers to leave voicemails on phones, so they'll take a number from a legitimate government entity and leave a voicemail with that," Nusbaum said. "The number that they're telling you to call back on is not the government agency; that is the scammers."

Instead of calling the number left in the voicemail, search for the main phone number for the department or agency (make sure you're looking on the official website) and call that one.

As for QR codes, they gained popularity during the pandemic, popping up everywhere as an easier alternative to searching for business and information online — but now scammers found a way to use them against you.

"And the newest one is quishing, which is using QR codes. So QR codes that are put out in public or hidden, so that people scan them instead of taking them to the website that they believe they're going to, it's taking them to the scammer's website," Nusbaum said.

Those websites can appear to be from trusted financial institutions that prompt you to provide your personal information, such as a PIN and your social security number, so be careful.

If you or a family member fall victim to identity theft, it’s important to act as quickly as possible.

Here's what to do:

- Start by reporting the fraud to the Federal Trade Commission. You can do that by going to IdentityTheft.gov.

- Place a fraud alert or security freeze on your credit reports, and review the information currently on there to make sure there’s no suspicious activity.

- If your personal financial information has been compromised, contact financial institutions and lenders you work with to alert them.

And remember that the U.S. Postal Service does not send text messages.

A good rule to live by: If an unknown sender messages you a link, don’t click on it.

If the message has spelling errors, that's a major red flag, Also, take a closer look at the sender's email or phone number, because they usually mimic real ones but there’re always a difference.

Emails, phone calls and text messages were the most commonly reported contact method used by scammers in 2023, the Federal Trade Commission said.