It’s the time of year when homeowners receive their property tax assessment bills, and they can save money if they know how to appeal.

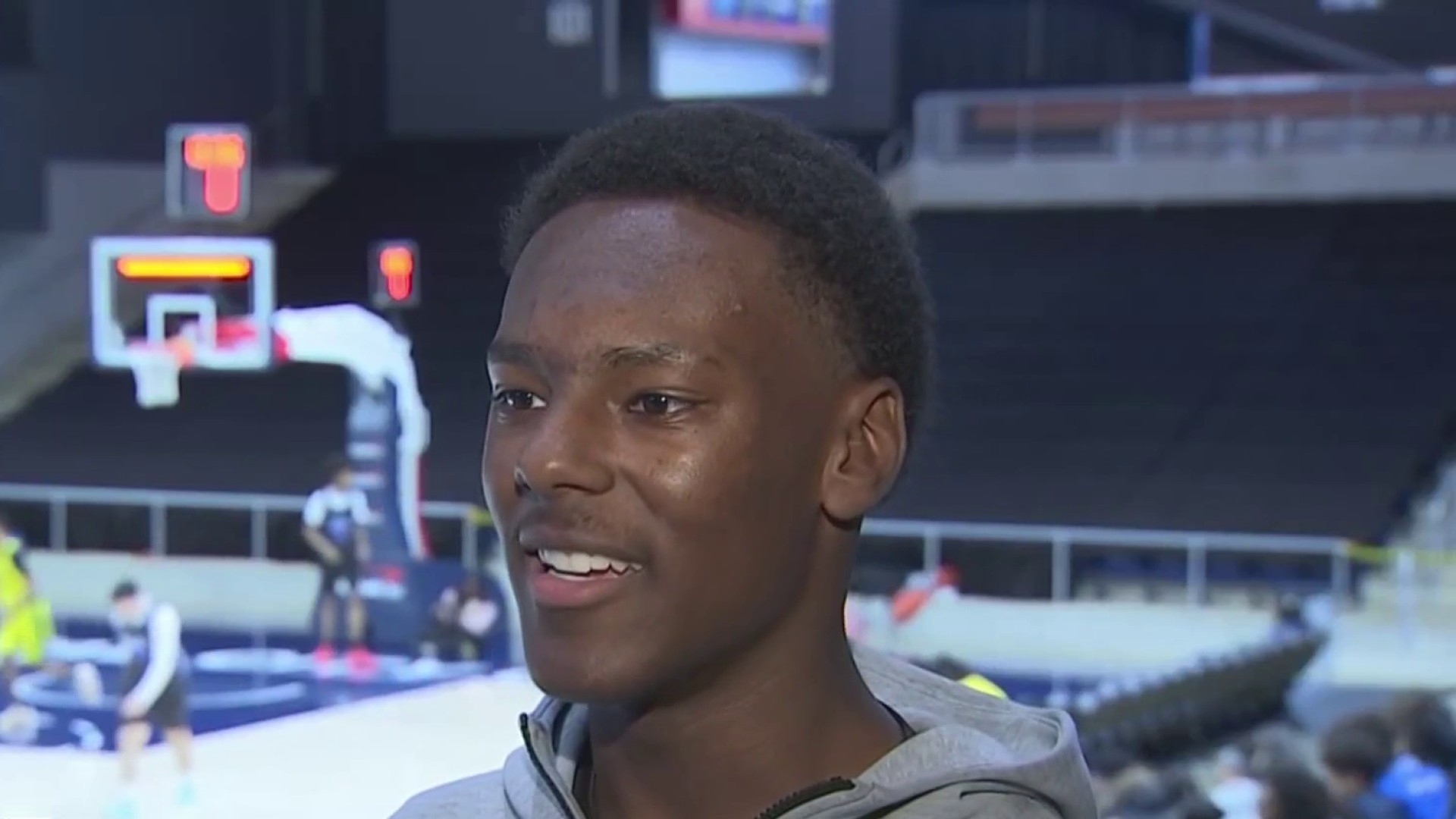

Real estate expert Evelyn Miller, a partner at SMART Settlements, says there are some things that can be done if the assessment seems too high.

“The first thing that you should do is, is first of all, open your bill and open it right away,” she said. “Don't delay, because if you do want to appeal your bill, these things are time sensitive. In most cases, you need to appeal within 30 to 45 days of receipt of the notice to make sure you actually open your bill. And then I would say scrutinize the bill. So, look line by line and make sure that everything is accurate. So, the size of your lot, for example, the amount of bedrooms listed. You want to make sure that there are no obvious errors. If there are that could be a really good reason to appeal.”

Usually, the notice comes with instructions to appeal — an online portal or form, depending on the jurisdiction.

We've got the news you need to know to start your day. Sign up for the First & 4Most morning newsletter — delivered to your inbox daily. >Sign up here.

How do tax assessors evaluate market value

“They do come out and actually audit the property,” Miller said. “Like, they can come out and actually view the property. They also look at comps in the neighborhood, so comparative sales. And the tax assessor is actually trying to capture the market value of your property. So, for example, if you just purchased a home and you purchased it on the open market, your tax assessment is most likely going to be almost exactly whatever your sales price was.”

Some homeowners may wonder why their tax rate is larger than their neighbor’s even if they have the same kind of house.

Local

Washington, D.C., Maryland and Virginia local news, events and information

“Sometimes there are mistakes,” Miller said. “But one thing to consider in both D.C. and Maryland, there is this thing called a homestead cap. So, if you are at the home as your principal residence, you can apply for homestead. Most people do. And if the county grants you the homestead cap, then what happens is that your taxes are cap. They cannot go up by more than 10% in a year. So, if your neighbors have had homestead for the last 15 years, then obviously their taxes may not be at market value. If you just purchased your house, the tax assessor is going to try to capture that sales price and what the real market value is right now.”

Talk to your real estate agent

Miller shared her main takeaway for homeowners.

“One of the best ways to kind of make a quick assessment of whether the assessment is too high is actually to talk to your real estate agent and ask your realtor if they can do a quick CMA, a comparative market analysis, for your property. They will pull the comps. This is the same thing that the tax assessor is supposed to do. But this is a really easy thing that most realtors are happy to do for you. Ask your realtor to pull comps for you, and you can easily kind of get an idea of whether your assessment is too high and whether it's worth on appeal.”

Deadlines to appeal property tax assessments

- April 1 is the deadline for appealing property tax assessments. If April 1 falls on the weekend, the deadline is the next business day.

- Appeals must be filed within 45 days of the notice date.

- March 1 is the deadline for appealing property tax assessments to the Department of Real Estate Assessments.

- March 15 is the deadline to request a review of the January assessment.

- June 1 is the deadline to request an appeal of the January assessment.

- April 7 is the deadline to submit an administrative appeal.

- June 30 is the deadline to file an appeal with the Board of Equalization (BOE).

- April 17 is the deadline for appealing an annual assessment to the assessor.

- June 2 is the deadline for appealing to the BOE.

Fairfax County, including Braddock, City of Fairfax, Clifton, Dranesville, Dulles, Franconia, Herndon, Mason, McLean, Mt. Vernon, Providence, Reston, Springfield, Sully, Tysons, Vienna

- April 3 is the deadline to submit an administrative appeal application.

- June 1 is the deadline to file an appeal with the BOE.

Loudoun County, including Hamilton, Hillsboro, Leesburg, Lovettsville, Middleburg, Purcellville, Round Hill

- March 18 is the deadline to submit the online request for assessment review with the Office of the Commissioner of Revenue.

- June 1 is the deadline to file an application with the Loudoun County BOE.

- June 1 is the annual deadline for filing an administrative appeal with the Real Estate Assessments Office.