Stocks staged an afternoon rally on Tuesday as concerns about a possible recession in the U.S. weighed on investor sentiment but lower interest rates appeared to boost the tech sector.

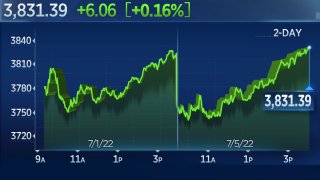

The tech-heavy Nasdaq Composite climbed 1.75% to 11,322.24 after opening the day sharply lower. The S&P 500 rose 0.16% to 3,831.39 after being down more than 2% at session lows. The Dow Jones Industrial Average closed down 129.44 points, or 0.4%, at 30,967.82 but was down more than 700 points earlier.

Concerns about economic growth are hanging over investors as the U.S. market looks to recover after a rough first half to the year. The market has dropped in four of the past five weeks, and the S&P 500 is more than 20% below its record high. Some economists believe U.S. GDP declined for both quarters to start the year, which is a shorthand used by many to signal a recession.

We've got the news you need to know to start your day. Sign up for the First & 4Most morning newsletter — delivered to your inbox daily. Sign up here.

The benchmark 10-year Treasury yield and the 2-year yield inverted on Tuesday, a move that has a strong historical track record as a recession indicator. When short-term Treasury yields trade above long-term yields, it could be a sign that investors expect an economic slowdown to lead to rate cuts.

Stocks tied to economic growth fell sharply on Tuesday, with machinery names Deere and Caterpillar falling 3.2% and 2.5%, respectively, and hitting their lowest levels of the year. Mining stock Freeport-McMoRan dropped 6.6%.

"The U.S. market is all about pricing in a slowdown, and pricing in the fact that the Fed is forced to hike rates into a slowdown," Allianz chief economic advisor Mohamed El-Erian said on "Squawk Box."

Money Report

However, the decline in interest rates may have boosted growth-oriented tech stocks, helping the Nasdaq outperform. Docusign and Zoom Video rose 6.7% and 8.5%. The Ark Innovation ETF, a volatile fund that tracks speculative tech stocks, jumped more than 8%.

Elsewhere, the price of oil also declined, reflecting a possible economic slowdown. U.S. benchmark West Texas Intermediate fell below $100 per barrel. Shares of oil giant Chevron dropped 2.6%.

Consumer discretionary stocks, which have been among the worst performers in recent weeks, helped the market recover from its lows of the session. Amazon and Nike gained more than 3%, while Target rose 2.3%. Cheaper oil prices could be a boost for these stocks as consumers adjust their spending patterns amid high inflation.

Elsewhere, shares of Ford fell 1% after the automaker's second-quarter sales rose more slowly than expected.

Markets finished one of the worst halves in decades on Thursday, and some on Wall Street believe an economic slowdown has been somewhat priced in to stocks.

The outlook for the second half of the year is murky. Credit Suisse strategist Jonathan Golub said in a note to clients on Tuesday that he expects the U.S. to avoid a recession but cut his S&P 500 target for the end of the year to 4,300 from 4,900. The new target would mean Wall Street claws back about half of its losses from the first six months of the year.

"Recessions are most accurately characterized by a meltdown in employment accompanied by an inability of consumers and businesses to meet their financial obligations. While we are currently experiencing a meaningful slowdown in economic growth (from extremely high levels), neither of the above conditions are present today," Golub wrote.

In this shortened holiday week, investors are looking ahead to the release of June jobs report data on Friday. According to Dow Jones estimates, job growth likely slowed in June with 250,000 nonfarm payrolls added, down from 390,000 in May. Economists surveyed expect the unemployment rate to hold at 3.6%.

May factory orders released on Tuesday showed stronger-than-expected growth. This week's economic calendar also includes Wednesday's release of minutes from the Federal Reserve's latest meeting.

On the political front, investors were watching a looming decision from President Joe Biden on whether his administration would roll back Trump-era tariffs on China goods. White House officials hope the switch would help ease the inflation burden.

Concerns about economic growth were also growing overseas. The Bank of England said Tuesday that the global economic outlook had "deteriorated materially." In currency markets, the Euro slid to a 20-year low against the dollar on Tuesday.