Nike continues to draw in sneaker fans and activewear lovers.

The retailer reported revenue of $12.4 billion for its third fiscal quarter of 2023, beating analysts' predictions of $11.47 billion, according to Refinitiv consensus estimates. The company also reported earnings per share (EPS) of $0.79, compared with the $0.55 analysts expected.

Additionally, the company reported that revenue rose 14% compared with the year-earlier period.

For several years, Nike has worked to expand its ability to sell directly to consumers rather than through other retailers. This has included increasing its digital sales, building experiential stores and bolstering its loyalty program.

We've got the news you need to know to start your day. Sign up for the First & 4Most morning newsletter — delivered to your inbox daily. Sign up here.

Nike Direct, the company's direct-to-consumer brand, sales rose by 17% during the holiday quarter to $5.3 billion, according to its quarterly report. Nike Brand Digital sales were up 20%.

But you'll still be able to find Nike products outside of the company's own stores and website.

In January, Nike CEO John Donahoe told CNBC that wholesalers remain "very, very important" to the company.

Money Report

"Consumers in this day and age want to get what they want, when they want it, how they want it, and in our industry, they've been very clear they want a premium and consistent shopping experience regardless of channel," he said.

To that point, Foot Locker touted a "revitalized" relationship with Nike during its "2023 Investor Day" presentation on March 20, saying the partnership is complementary to Nike's direct-to-consumer strategy.

What this means for investors

Nike reported its fiscal third-quarter results after the bell on March 21. The following day, shares declined slightly by almost 5% and ended the trading session at $119.50 per share.

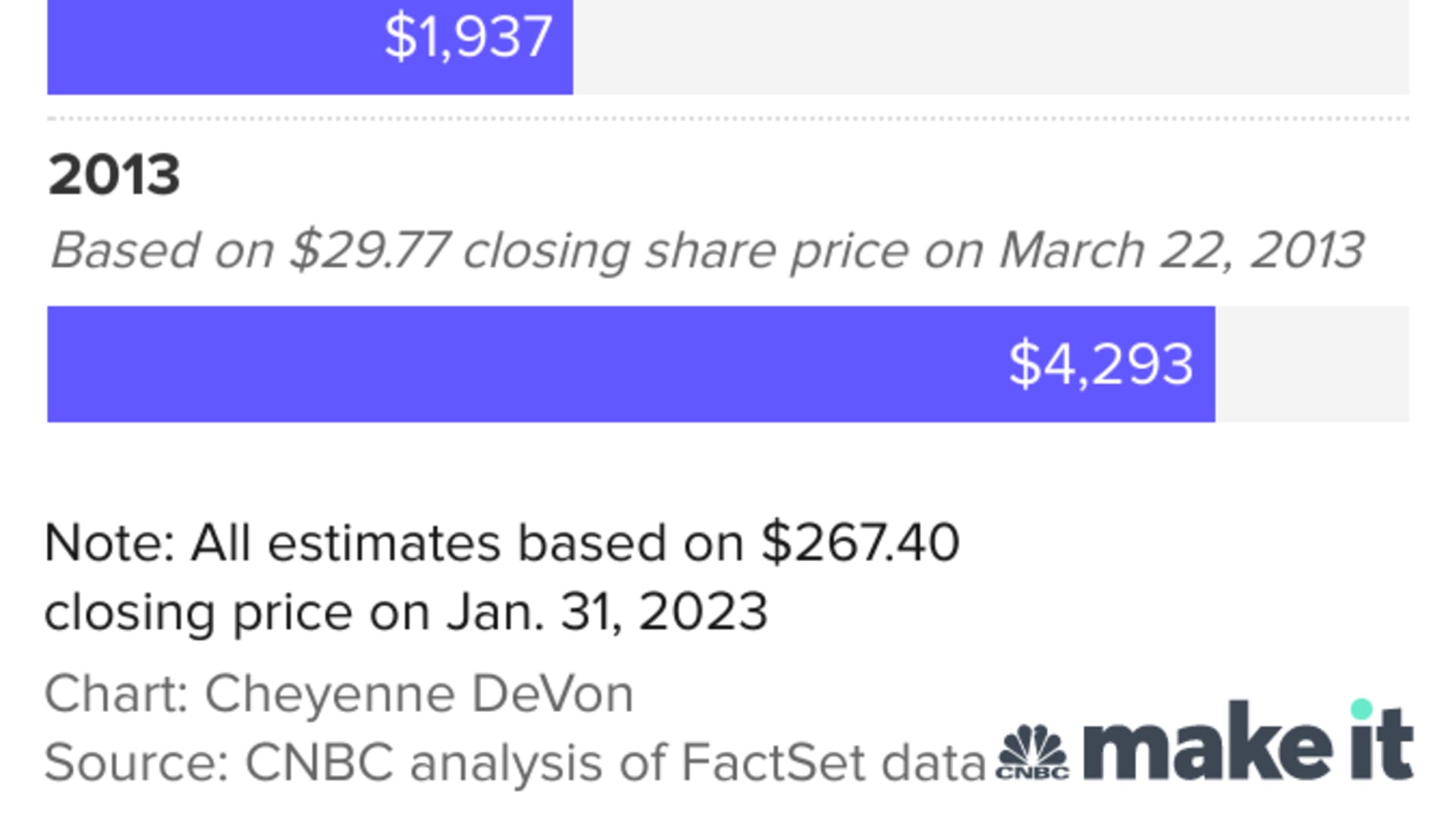

Here's how much money you'd have as of March 22 if you had invested $1,000 into the company one, five and 10 years ago.

If you had invested $1,000 into Nike a year ago, your investment would be worth about $908 as of March 22, according to CNBC's calculations.

If you had invested $1,000 into Nike five years ago, your investment would have nearly doubled to $1,937 as of March 22, according to CNBC's calculations.

And if you had put $1,000 into Nike a decade ago, it would have more than quadrupled to $4,293 as of March 22, according to CNBC's calculations.

Investors should do their research

Remember, there isn't an infallible way to predict how the stock market may behave in the future. Just because a stock is performing well currently doesn't necessarily mean it will continue to do so going forward.

Instead of picking stocks to invest in one-by-one, a more hands-off investment strategy tends to make sense for most investors. A popular way to start is by investing in low-cost index funds such as the S&P 500, which is a market index that tracks the stock performance of the 500 largest, publicly-traded companies in the U.S.

Experts typically recommend this strategy because it can diversify your portfolio by adding exposure to a wide array of companies.

As of March 22, the S&P 500 declined slightly by close to 13% over 12 months, according to CNBC's calculations. However, the index has risen by about 49% since 2018 and grown by about 153% since 2013.

DON'T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter

Get CNBC's free Warren Buffett Guide to Investing, which distills the billionaire's No. 1 best piece of advice for regular investors, do's and don'ts, and three key investing principles into a clear and simple guidebook.

Check out: Self-made millionaire: You don’t have to give up lattes to get rich—do this instead