- The two top retailers issued cautious U.S. consumer outlooks for 2023 last week.

- Walmart said consumer spending would start the year strong, but fade.

- Home Depot expects revenue to be flat this year, but bolstered by home equity.

- The retail sector had its worst week since July 2022, and yet, the latest inflation and retail sales data show consumer spending to be stronger than economists forecast.

If you think the economy is confusing right now, consider how baffling it must look to Home Depot and Walmart.

Last week, the two big retailers sent cautious signals about the health of the U.S. consumer. In a nutshell: Walmart said U.S. consumer spending started the year strong, but that it expect households to back off through the year, producing weak fiscal-year 2024 U.S. sales growth of 2 to 2.5 percent. Home Depot said consumer spending is holding up, but that it expects a flat sales-growth year overall, with declining profits.

Indeed, the latest inflation read from last Friday's core personal consumption expenditures index was hotter than expected, showing a consumer that continues to defy expectations. Friday's PCE showed consumer spending rose more than expected as prices increased, jumping 1.8% for the month compared to the estimate of 1.4%.

We've got the news you need to know to start your day. Sign up for the First & 4Most morning newsletter — delivered to your inbox daily. >Sign up here.

From the big-box retail earnings to declining hopes that disinflation would be a straight line down in 2023, the latest news from the markets and economy highlight just how hard a job the Federal Reserve has in cooling the economy without causing a recession.

"The consumer is resilient right now," said CFRA Research retail analyst Arun Sundaram. "The consumer is still spending, not as much as a year or two ago, but they haven't quite stopped."

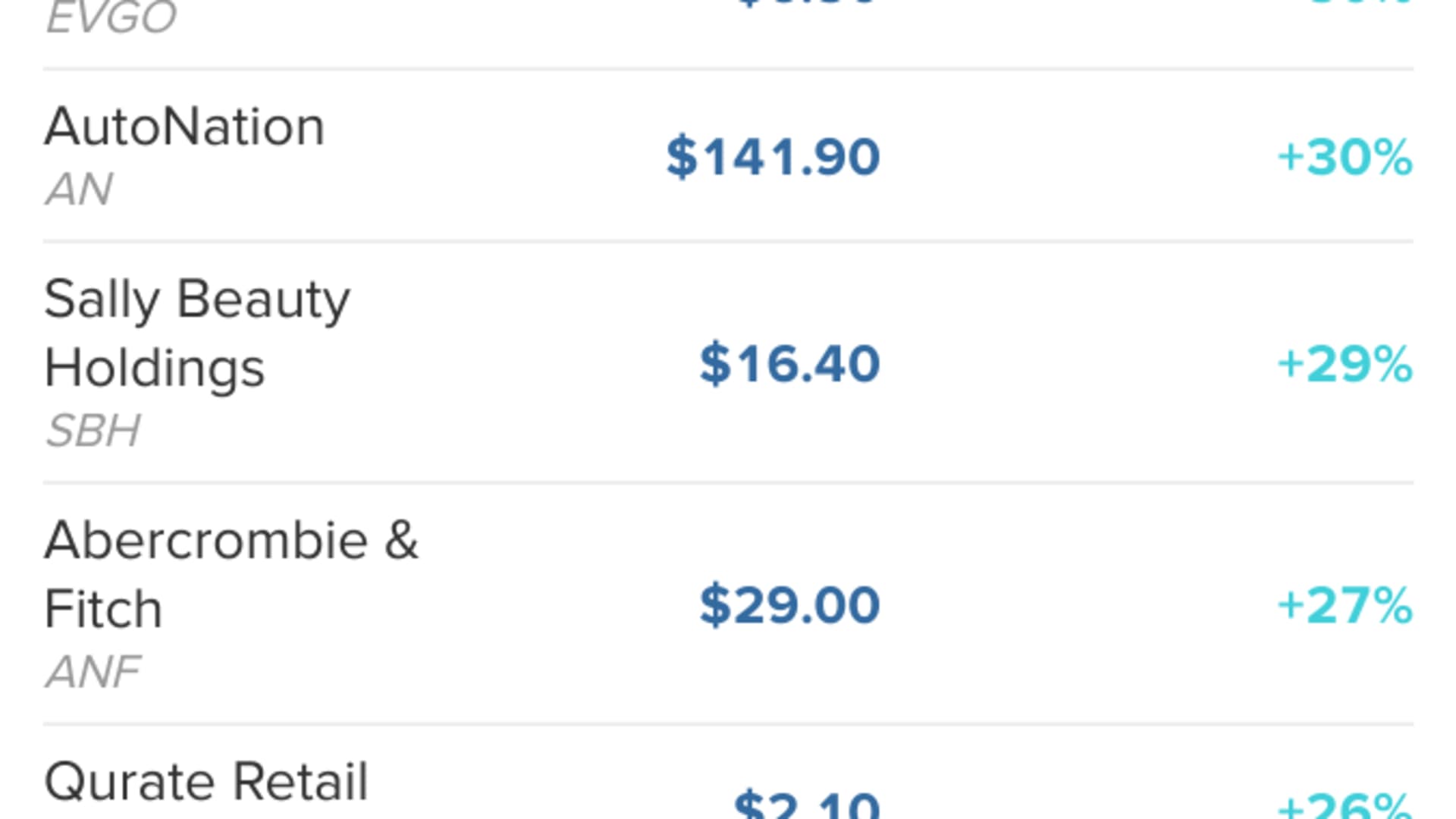

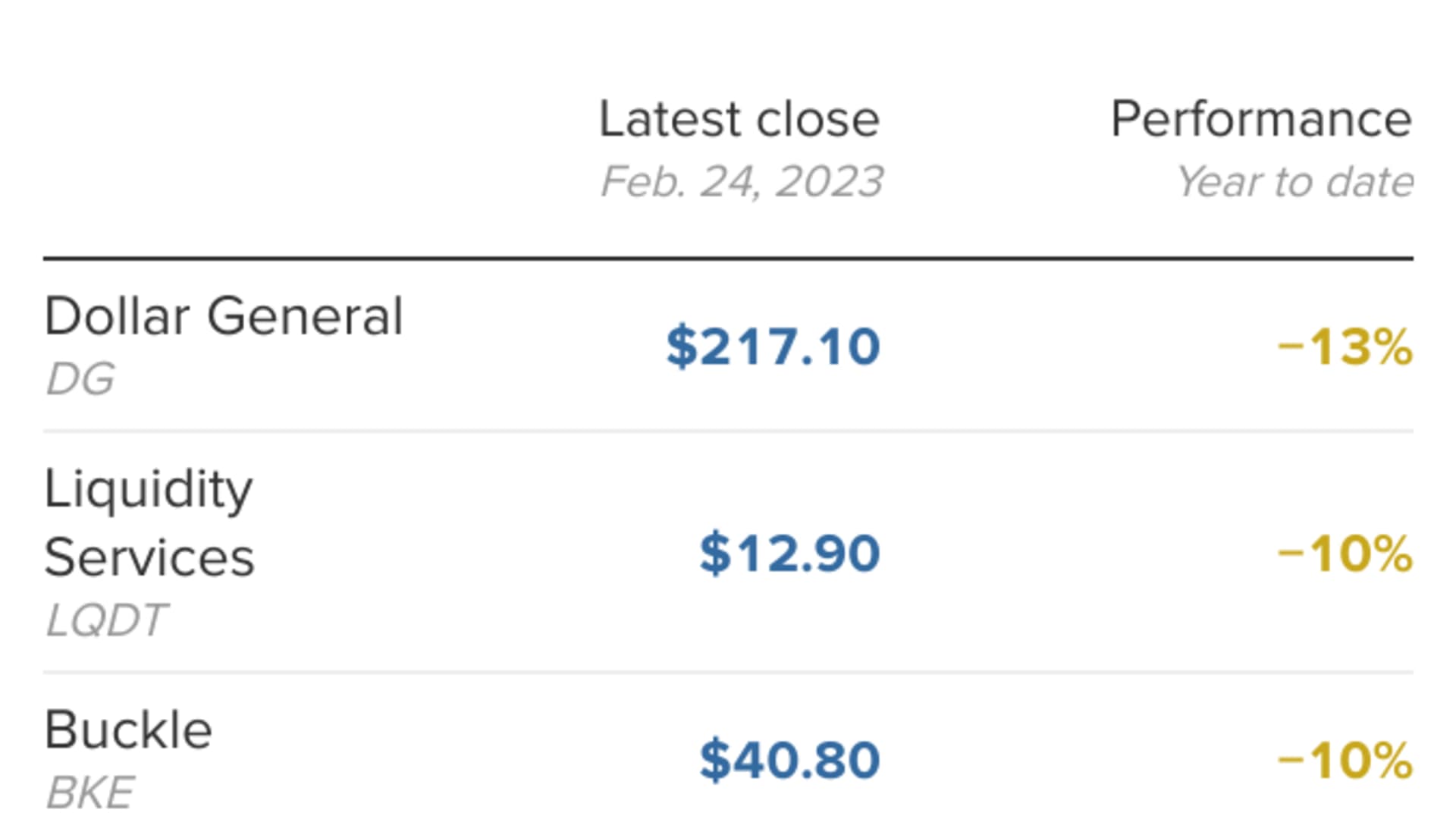

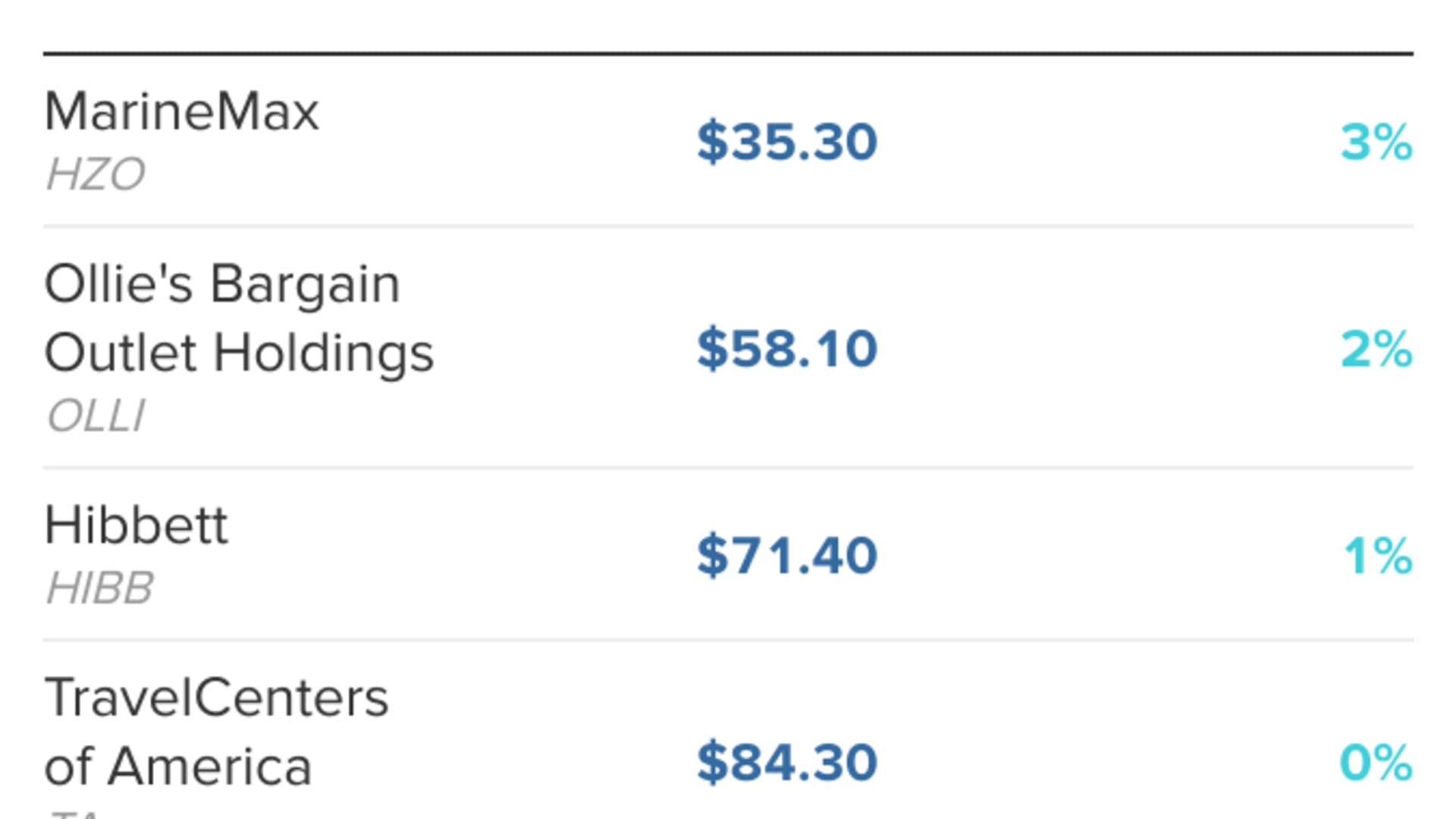

Consumer, retail stocks post a very bad week

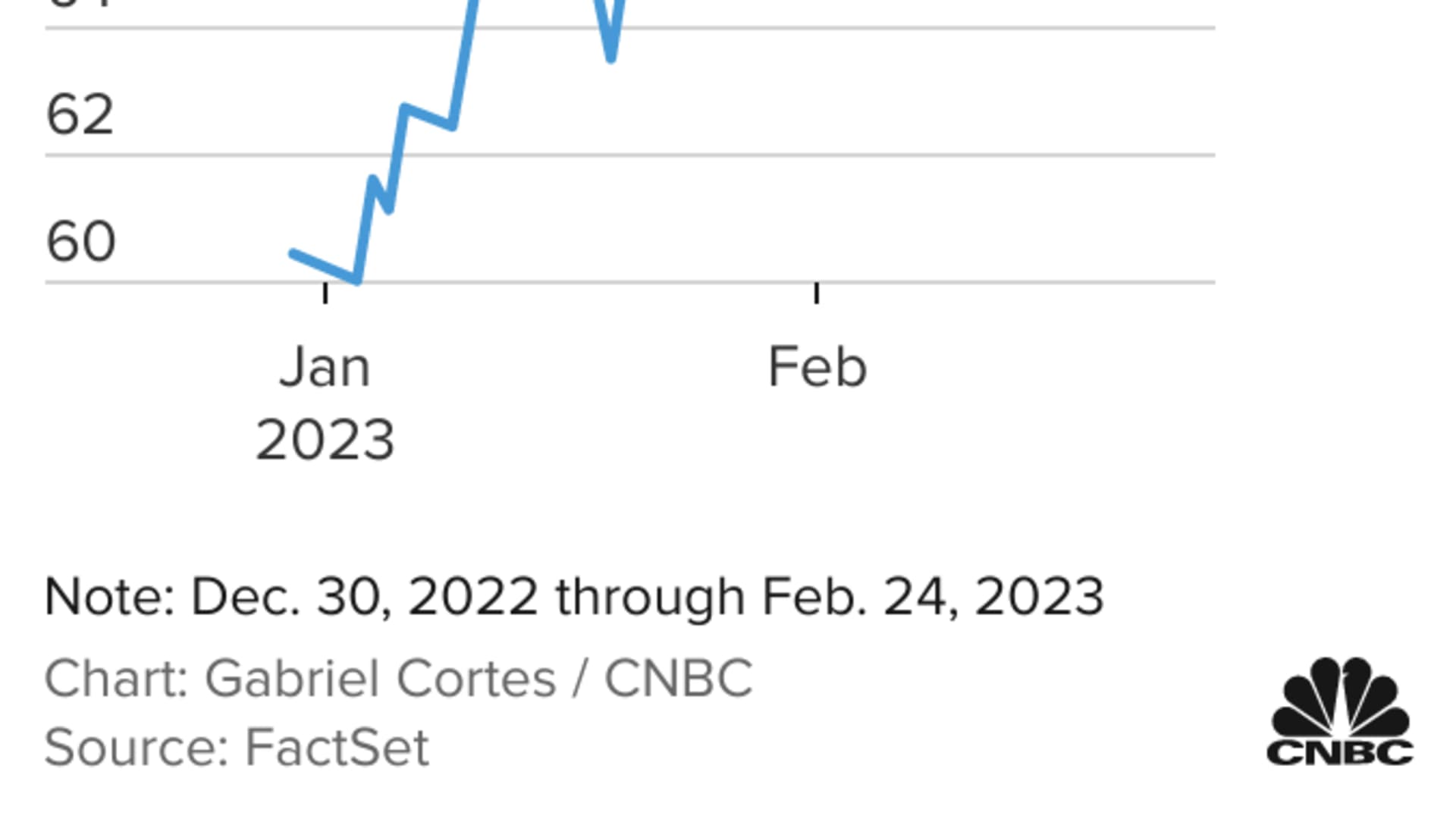

The 2023 outlook from these two key consumer companies sent the Dow and S&P 500 down on Tuesday, and the market's recent losing streak continued through the end of the week. It wasn't a good week for the retail sector or consumer stocks, either. The SPDR S&P Retail ETF is up 9% for the year, but was down roughly 7% last week, its worst five-day stretch since July 2022. Consumer discretionary stocks turned in the worst performance of any S&P 500 sector, down close to 4.5% for the week.

Getting a good read on the consumer has been a question underlying markets' debate about inflation, as investors wonder whether households that last year lost 6.4% of their inflation-adjusted disposable income — which rose more than 8% in the prior two years, thanks to Covid relief programs — will keep spending. January's relatively-high inflation offset the boost to market sentiment from a recent rip-roaring report on retail sales, leaving investors, and even top stores, with different views of what comes next.

Money Report

At the macro level, the January retail sales increase of 3% more than reversed a December decline and, landing 6.4% higher than a year ago, basically matched inflation. The University of Michigan's consumer sentiment index has risen since November, and its latest read last Friday showed a confidence boost for the third-straight month, led by a 12% improvement in consumers' outlook over the economy for the year ahead. The rival Conference Board consumer conference survey says Americans thought conditions were improving in January, but expect a recession later this year.

The big-box store view of spending

Walmart has been able to keep sales growing by expanding its grocery business, but those sales are less profitable than general merchandise categories where consumer spending is leveling off or shrinking. It's compensating through investments in more-efficient operations, and boosting its online unit's high-margin advertising business.

"Attempting to predict with precision the swings in macroeconomic conditions and their effect on consumer behavior is challenging," Walmart chief financial officer John Rainey told analysts on the company's recent earnings call. "As such, our guidance reflects a cautious outlook on the macro environment."

Home Depot expects high home equity to prop up consumer demand at least for a while, before pressures from inflation and interest rates squeeze harder. Existing homes sales posted their twelfth-straight monthly decline in January, but a slower pace of decline led to some optimism that the housing market could be near a bottom.

"We also still see a healthy customer. We have good jobs, job growth, growing wages, still strong balance sheets," Home Depot CEO Ted Decker told analysts on itsrecent earnings call. "We do see a unique environment with many cross currents right now. Obviously there's heightened inflation and rising interest rates, the tight labor market and moderating equity and housing markets. So given all of that, we do expect moderation in home improvement demand."

Home Depot was the second-worst performing stock in the Dow last week, down nearly 7% — the only Dow stock that did worse was Intel, which cut its dividend by 65%.

Among Wall Street firms, Goldman Sachs' economists take the view that the consumer strength can continue, saying household income growth bottomed out in 2022 as Covid-related income support programs ended, and will rebound this year, bolstering companies, including Walmart in particular. Goldman economists expect disposable personal income to grow 6.1% this year, compared to a 0.4% decline in 2022, according to a recent report, driven by rising wages and higher profits for small business owners. That means consumers can spend more without dipping into savings and investment gains.

"The outlook for sustained consumer spending growth remains," wrote consumer analyst Jason English. "Growth in [disposable income] and moderation in essential spending inflation mean that spending growth will no longer need to be funded from net savings, with [a] bounce back in the savings rate expected beginning in the first quarter of 2023."

Friday's PCE report showed that the personal savings rate was up, rising to 4.7%.

Home prices, groceries, inflation

At Morgan Stanley, retail analyst Simeon Gutman described what he saw as a notable difference in the outlook from the two big retailers after last week's earnings. His take: Home Depot's customer is richer than Walmart's, propped up especially by the home equity gains of recent years. But Home Depot's view may fail to account fully for coming declines in home prices, he suggested.

"WMT's more sobering consumer outlook is undoubtedly informed by the weakness it has seen in general merchandise and the overall mix shift to [groceries, which are less profitable]," Gutman said. "HD's more balanced view may underestimate the lagging impact of a rapid deceleration in housing metrics."

There may be a simple way to square the conflicting signals on the consumer and the retail numbers, said Richard Moody, chief economist at Birmingham-based bank holding company Regions Financial. Walmart may be seeing an impact sooner from inflation, which will continue, albeit at a slower pace, into the second half of the year.

"The cumulative effects of high inflation will take a toll, and a slowing pace of growth in labor earnings will also weigh on spending," Moody said. "Remember, even as inflation slows, prices are still rising, they're just rising at a slower rate, so lower inflation isn't going to unleash a bunch of cash for consumers to spend."

But Home Depot may benefit from a decline in interest rates in late 2023, producing a modest but steady rate of growth consistent with the bank's outlook for the single-family housing market, he said.

Fed, interest-rate forecasting

Predicting where rates end in 2023, though, is no easy task. This year started with the bond market confident the Fed was nearing the end of rate increases and increasing its odds that the Fed would cut before year end as inflation slowed and it started to look more likely the economy achieved a "soft landing." But after two straight hotter-than-expected consumer inflation reads in recent weeks from CPI and PCE, there is now talk of the Fed potentially raising 50 basis points at the next meeting, and the "higher for longer" view of where rates end of the year (over 5%) is suddenly back in the driver's seat among Fed watchers.

The upshot, heading into earnings reports by retailers like Costco and Target next week, is that there's upside in stocks like Walmart if consumers prove to be healthier than either company's guidance implies, Gutman said. And the minutes of the Fed's January meeting threw out one idea markets haven't yet focused on: That states, which have doubled the size of their rainy day funds since 2018 partly by hanging on to some Covid-driven federal aid, could give consumers money by cutting taxes.

"[P]articipants noted that inflation was eroding households' purchasing power," the minutes reported. "However, a couple of participants noted that some states could return part of their sizable budget surpluses to households through tax cuts or rebates, which would provide support to consumption."