While fewer checks are being written these days, check fraud continues to be widespread, and it’s surging. Many victims might not even know it's happened to them.

That was the case when the News4 I-Team recently went knocking on the door of a man in Falls Church, Virginia.

"Oh, I'm becoming an expert," he told Consumer Investigative Reporter Susan Hogan. "I probably know as much about this crap as anybody."

He agreed to talk with News4 if he could stay anonymous, since this, unfortunately, was not his first time dealing with stolen checks.

“This one knocked my socks off,” he said.

How the check was stolen

Six of the man’s checks, which he wrote and mailed in July, were stolen and found for sale on the social media app Telegram, along with dozens of other checks from the Falls Church and Arlington area.

Investigations

Investigations by the News4 I-Team

“So, it looks like the criminals hit one specific mailbox or two in in those specific areas,” said David Maimon, director of the Evidence-Based Cybersecurity Research Group at Georgia State University.

His team recently spotted the stolen checks online.

“What the team does on a daily basis is simply monitor hundreds of groups trying to find interesting information for us to work with, monitor trends on the ecosystem, in order to really try and understand what criminals are working on, what are some of the hot commodities that they have under disposal and what is it that they're offering for sale,” Maimon said.

He said the sheer number of stolen checks, all from the same area, and private information brazenly shown quickly caught his team's eye.

"Not even covering the addresses and names of the victims – this was kind of unusual in this ecosystem,” Maimon said.

When checks are stolen from the mail, identity theft experts say they're usually washed, with the ink removed, so that criminals can change the payee name and dollar amount.

Checks are sold to the highest bidder online and often bundled with other stolen information, said James Lee, with the Identity Theft Resource Center.

“Where they sell them, though, is not on the dark web so much as it is now YouTube and Telegram and other channels that are in the open. The volume is so high they don't need to hide and they tie these now into a full set of credentials,” he said. “You can get checks, you can get driver's licenses, you can get state IDs, you can get debit cards all tied to the same identity – all tied to the same accounts.”

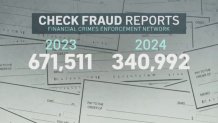

The I-Team found that last year, banks filed almost 700,000 suspicious activity reports with the Financial Crimes Enforcement Network for check fraud. So far in 2024, they have filed more than 340,000.

The homeowner in Falls Church said this is the third time he's been the victim of check fraud.

"The first time that this happened, which was about eight months ago, the check was washed. I believe it was maybe a utility bill. So, let's say $200. And I believe it was [washed] for over $100,000,” he said.

Fortunately, his banks caught the suspicious activity.

“So far, I've not been out any money, but I've been into a lot of aggravation,” he said.

The U.S. Postal Inspection Service, which investigates mail theft, wouldn't confirm to the I-Team if the stolen checks in Falls Church were being investigated.

How to avoid falling victim to check fraud

The safest way to avoid check fraud is simply to not write checks, Lee said.

"If you have to write a check … do it in a way where you can know when it leaves and check on it along the route. So, if it's so important, go ahead and get tracking on it,” he said. “If not, check with the organization after a certain amount of time and say, did you receive my check? So you can begin to trace it if it doesn't show up in time.”

Avoid dropping checks in blue mailboxes, if possible, Lee said.

That’s something the Falls Church check fraud victim said he’s started doing.

“I no longer put things in the mailbox. I go directly to the post office,” he said.

That didn't seem to stop this latest financial frustration, though.

If you find out your checks have been stolen, Lee advises that you:

- notify your bank immediately

- get a new checking account number

- freeze your credit

- sign up for alerts on your accounts to monitor activity

Reported by Susan Hogan, produced by Rick Yarborough, shot by Lance Ing and Carlos Olazagasti, and edited by Carlos Olazagasti.