A Virginia homeowner almost lost her home a few years after getting a reverse mortgage because she defaulted on the homeowner’s insurance.

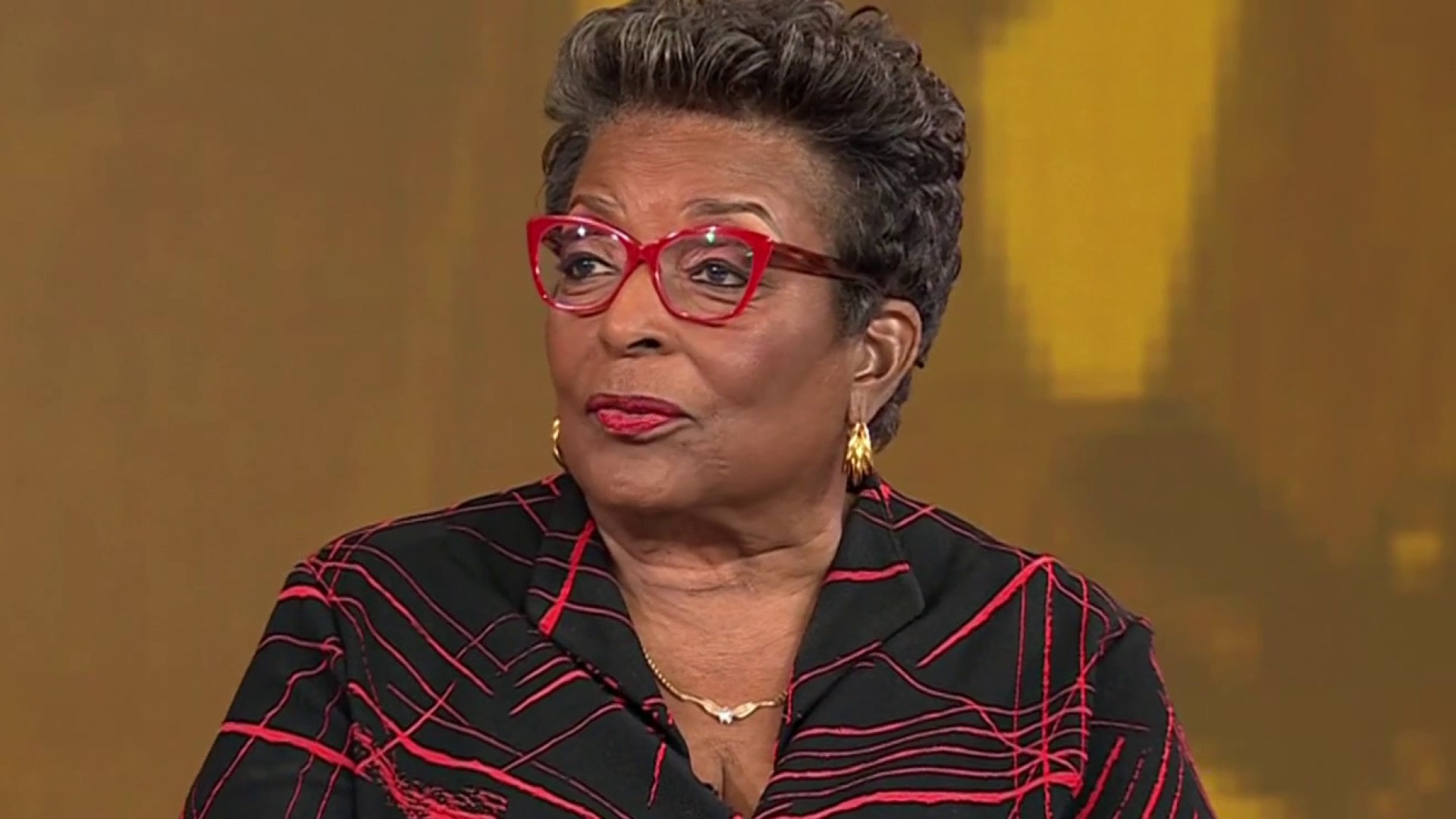

Becky Williams and her two young sons live with the Manassas homeowner, where Williams serves as the homeowner’s caregiver and power of attorney.

A few years ago, the homeowner did a reverse mortgage. Williams, who takes care of the bills, thought everything was going OK until she received a foreclosure notice in the mail.

“This is really going to happen? I mean, can they really do this?” Williams said. “I started calling lawyers, attorneys to find out, and yeah, it was really going to happen.”

Defaulting on homeowners insurance prompted the foreclosure.

They quickly sent out a check, Williams said, but it was returned. The auction was already scheduled.

“This is our home,” Williams said. “You know, she's worked all her life for this house and paid it off, and I'm supposed to be the caregiver and I was really disappointed in myself.”

Local

Washington, D.C., Maryland and Virginia local news, events and information

NBC4 Responds contacted the companies involved, including Reverse Mortgage Solutions, who said although borrowers are not required to make principal or interest payments, they do have an obligation to pay real estate taxes and property insurance.

The company can't discuss specific cases out of respect for customers’ confidentiality, however, in a statement to News4, they said, "In the event that these obligations are not met, Reverse Mortgage Solutions works closely with our customers to establish repayment plans or other remedies."

Williams said they called off the auction and worked with her, and the homeowner kept her house.